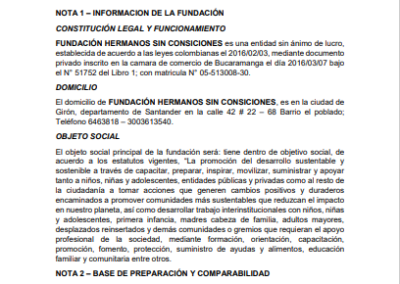

FHSC URIBIA

COMUNICADO A LA OPINIÓN PÚBLICA

About us

We are a Non-Profit Organization that through various innovative social programs seeks to provide well-being to vulnerable families, where feeding children is the fundamental objective.

MISSION

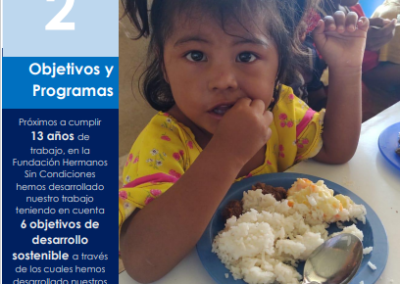

We are an organization that seeks to provide the integral well-being of children from vulnerable communities, by solving the difficult nutritional, moral and school situation.

VISION

Consolidate ourselves as a pioneer organization in the development of social projects aimed at children; Aiming at the materialization of a CDI to change the reality experienced by many of the vulnerable children and young people of the Girón and Uribia municipality

VALUES

Commitment and social responsibility

Experience

Accessibility

Networking

Solidarity

How to help

In our organization we offer you multiple linking programs so that you can be part of this beautiful work.

Ingresa y busca cual es la que más te gusta

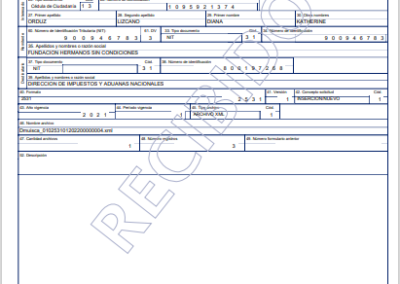

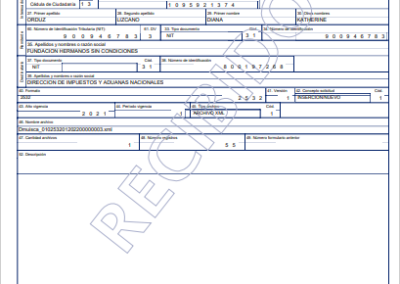

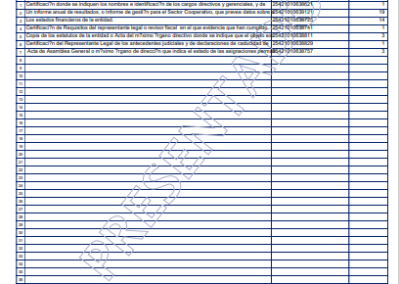

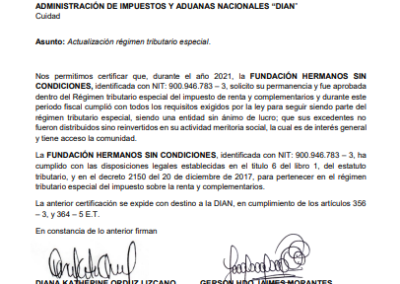

Art. 364-5. Web registration and submission of comments from civil society.

All entities that intend to be qualified in the Special Tax Regime must register in the web application indicated by the DIAN. The purpose of the record dealt with in this article is that the qualification process is public, that the community rule on the requirements for access to the Special Tax Regime, and that it submit general comments and observations on the respective entity. The National Government will regulate the terms and conditions referred to in this article.

The requesting entity must, during the term established in the regulations for qualification within the Special Tax Regime, upon request of the DIAN, submit the corresponding explanations to reject the comments and observations presented by the community.

The entities qualified in the Special Tax Regime must update annually, in the first 3 months of each year, the information to which this registry refers.

PARAGRAPH 1. The request for qualification in the Special Tax Regime includes the authorization to publish the data contained in the registry.

CONTACTS

If you want to be part of our Foundation or you want to contact us, send us your information

Contact

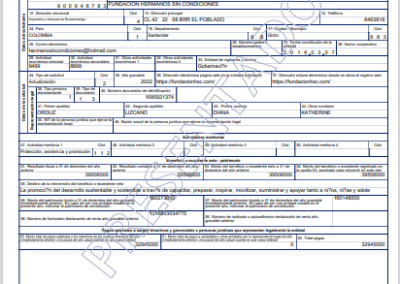

Tel: (601) (097) 6463818

Cel: (+57) 3183603161 – 3005478848

Correo: contactanos@fundacionhsc.com

Dirección

Calle 42 N° 22-68 El Poblado – Girón

Santander – Colombia